cap and trade versus carbon tax

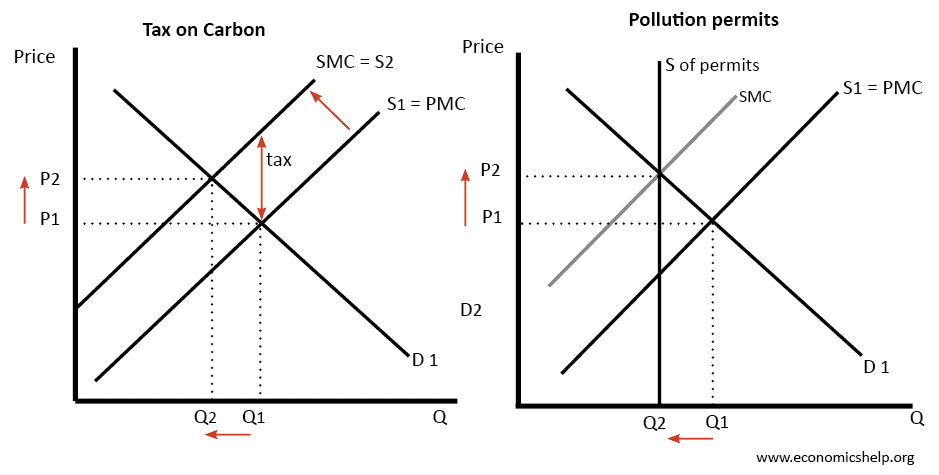

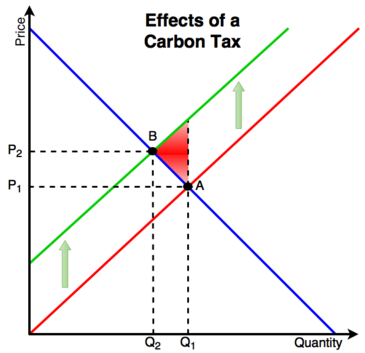

Both a carbon tax and a cap-and-trade system would result in higher energy costs to consumers. Carbon tax approaches however can be designed such.

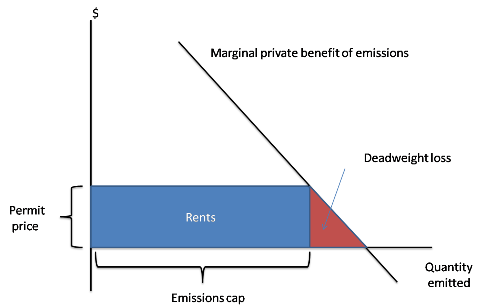

Pollution Permits Economics Help

Economists have come up with to address climate change.

. However in reality they differ in. In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. Republicans for Environmental Protection.

Carbon taxes vs. Goulder Andrew Schein Working Paper 19338 DOI 103386w19338 Issue Date August 2013 We examine the relative. The first is a carbon tax and the.

Theory and practice Robert N. At the same time the economys performance affects the. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

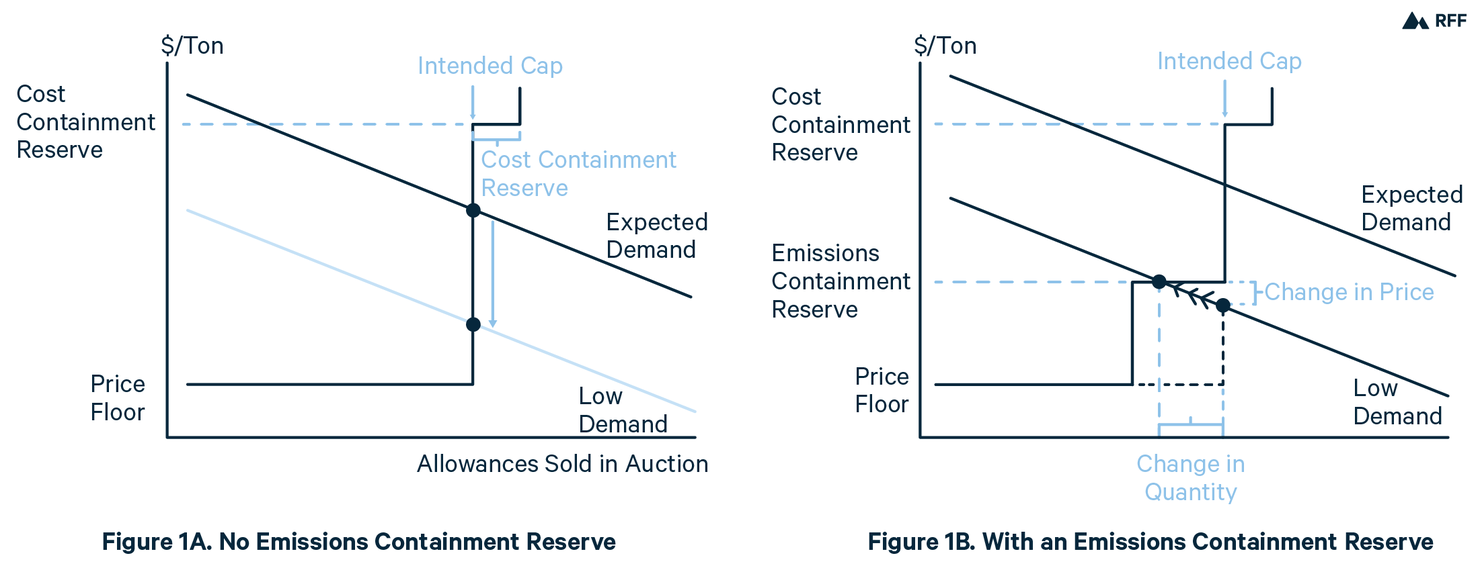

Governments enforce Cap and trade programs. I find it really hard to believe but the perennial carbon tax vs. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

Carbon Tax vs Cap-and-Trade. Basis Cap and Trade Carbon Tax. Carbon taxes and cap-and-trade are the two big ideas US.

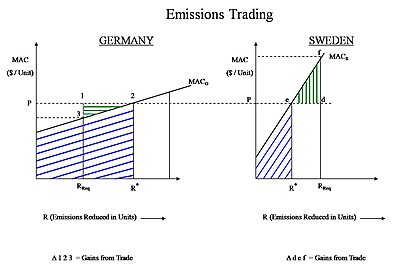

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap-and-trade program issues a set number of emissions allowances each year. It goes on and on and on and it never changes. Cap-and-trade has one key environmental advantage over a carbon tax.

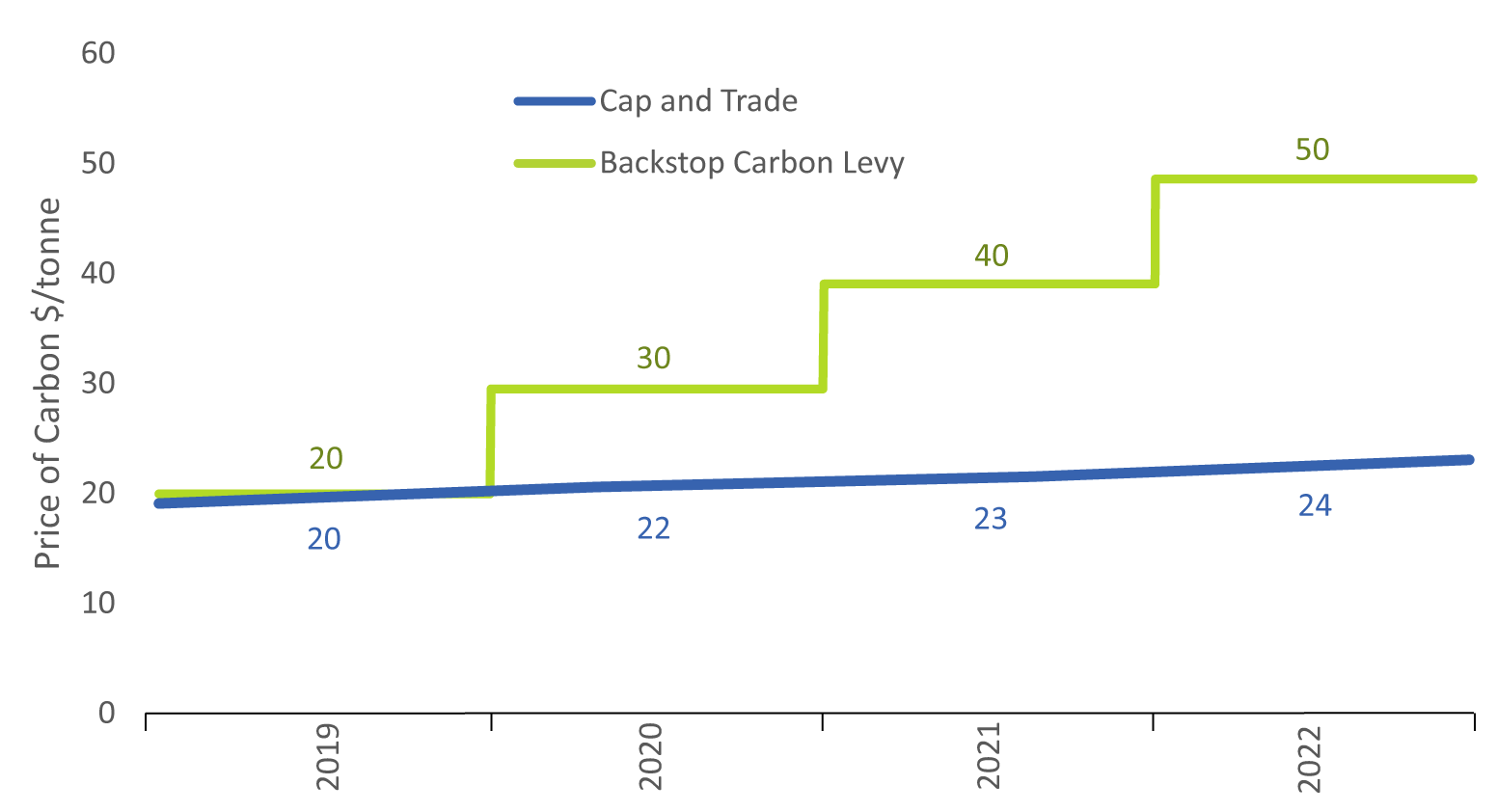

Cap-and-trade debate is still going on. The difference between both the regulations are as follows. The comparison of the two carbon pricing policies mainly implies that a carbon tax is more cost-effective than cap-and-trade for a carbon- and trade-intensive economy but cap-and.

Jim DiPeso Jim DiPeso. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages. A Critical Review Lawrence H.

The impact of the carbon tax and cap-and-trade on a countrys economy is significant. Carbon tax versus cap-and-trade. A get complementary policies up andrunning quickly and b get some kind of carbon pricing scheme inplace which in future years -- as the.

Search for more papers by this author. The focus should be twofold. Cap and Trade vs Carbon Tax.

It provides more certainty about the amount of emissions reductions that will result and little certainty about the price of. Cap Trade Carbon Markets If a governing body wishes to reduce emissions they generally have two levers to pull. Carbon taxes put an initial financial burden on entities that.

Carbon Tax vs.

Carbon Tax Pros And Cons Economics Help

Carbon Policy Bc Carbon Tax Link To The World

The Lazy Economist Carbon Tax Versus Cap Trade The Journal

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Versus Cap And Trade

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar

The Textbook Economics Of Cap And Trade The New York Times

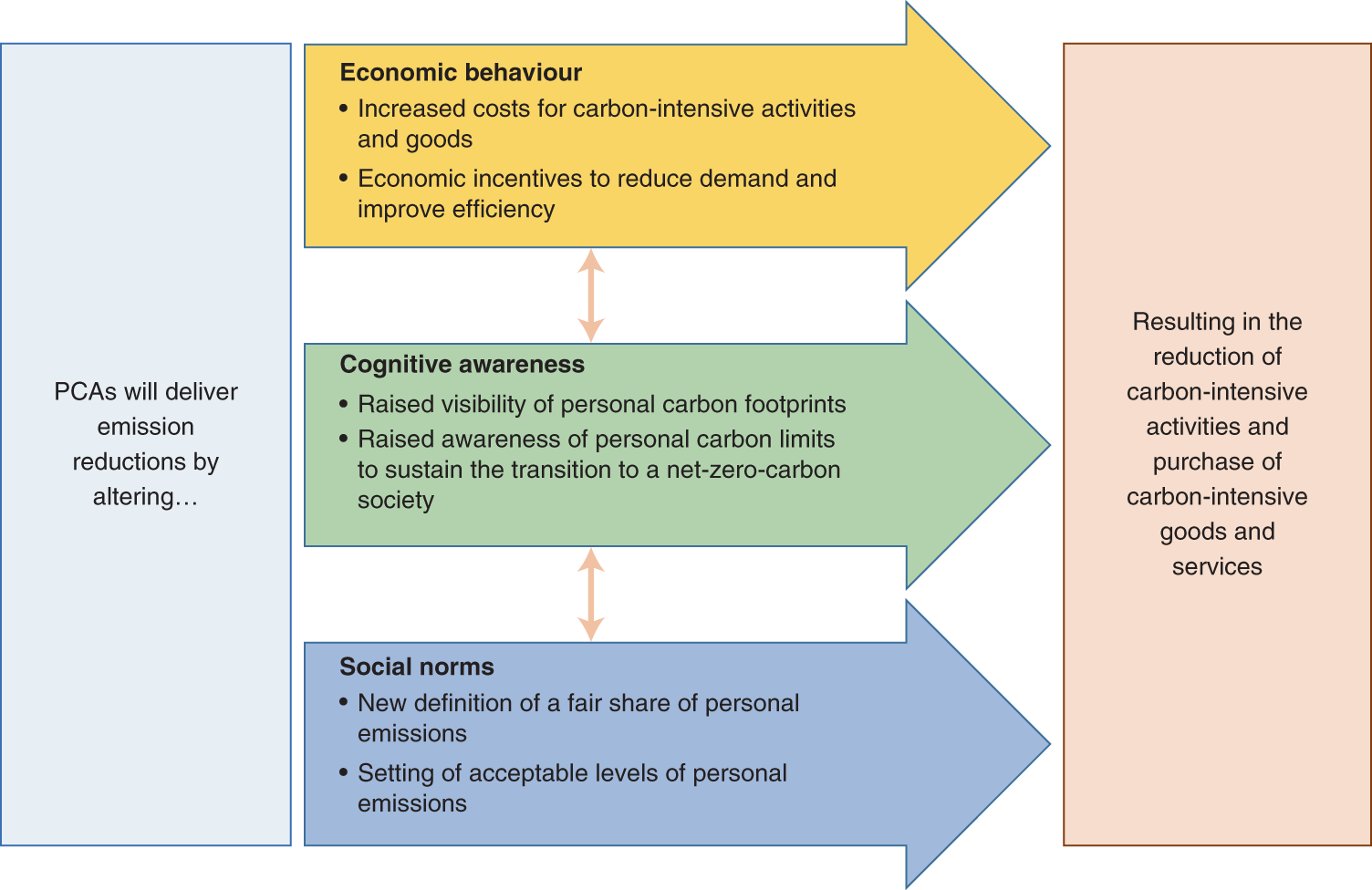

Personal Carbon Allowances Revisited Nature Sustainability

Where Carbon Is Taxed Overview

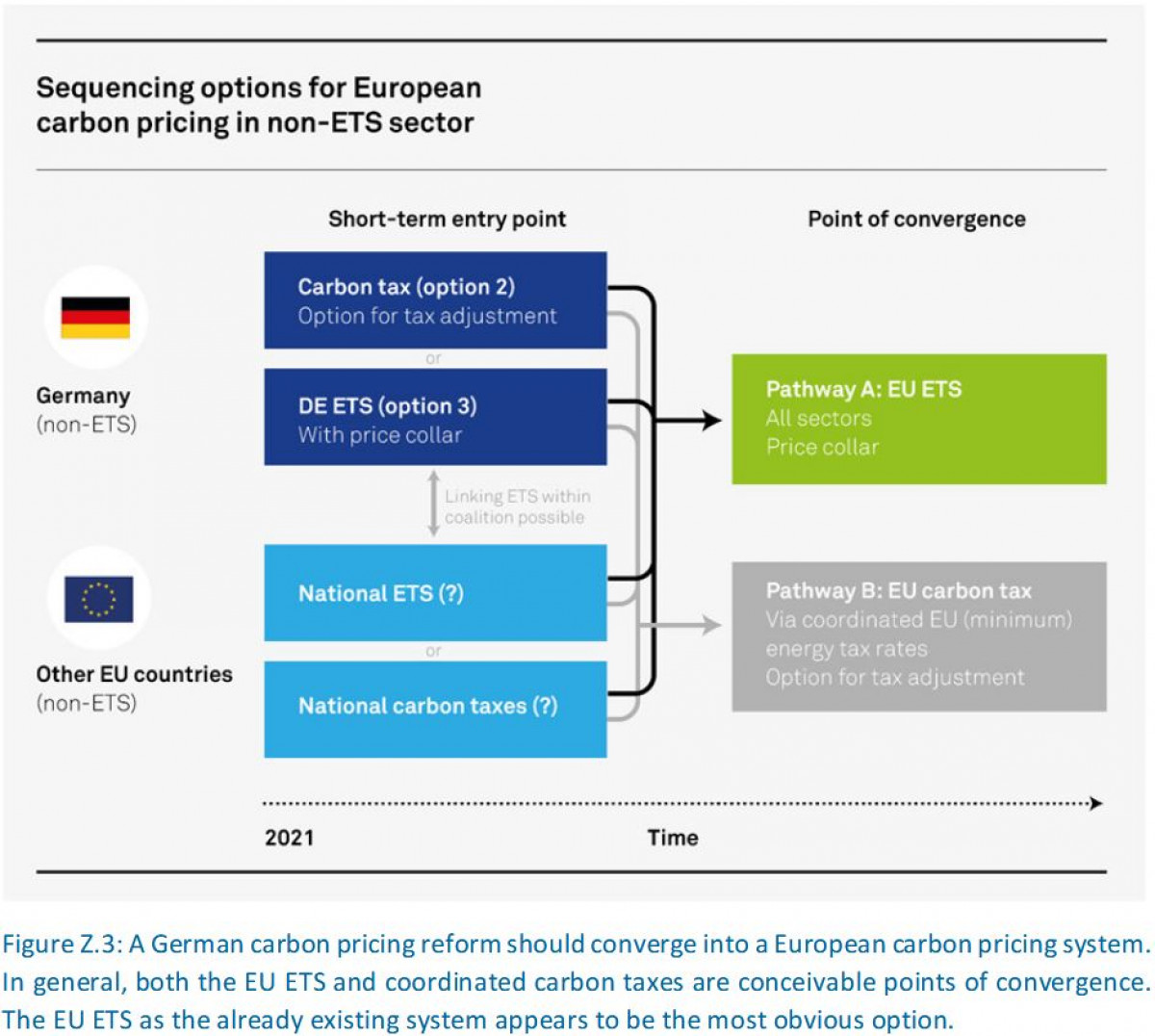

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Carbon Tax Vs Emissions Trading Energy Education

Carbon Pricing 301 Advanced Topics In Carbon Pricing In The Electricity Sector

27 Main Pros Cons Of Carbon Taxes E C

Economist S View Carbon Taxes Vs Cap And Trade

Cap And Trade Vs Carbon Tax Power Sector Profits Versus Time For The Download Scientific Diagram